A better experience for sellers and buyers. When you issue invoices quickly in real time, input tax credits will be processed faster.

What is e-invoicing

E-invoicing is the process of generating invoices in a digital format, so you can issue and store them electronically.

The Zakat, Tax and Customs Authority (ZATCA) in the Kingdom of Saudi Arabia (KSA) has rolled out regulations mandating

businesses to adopt an e-invoicing process in two phases, starting on December 4, 2021.

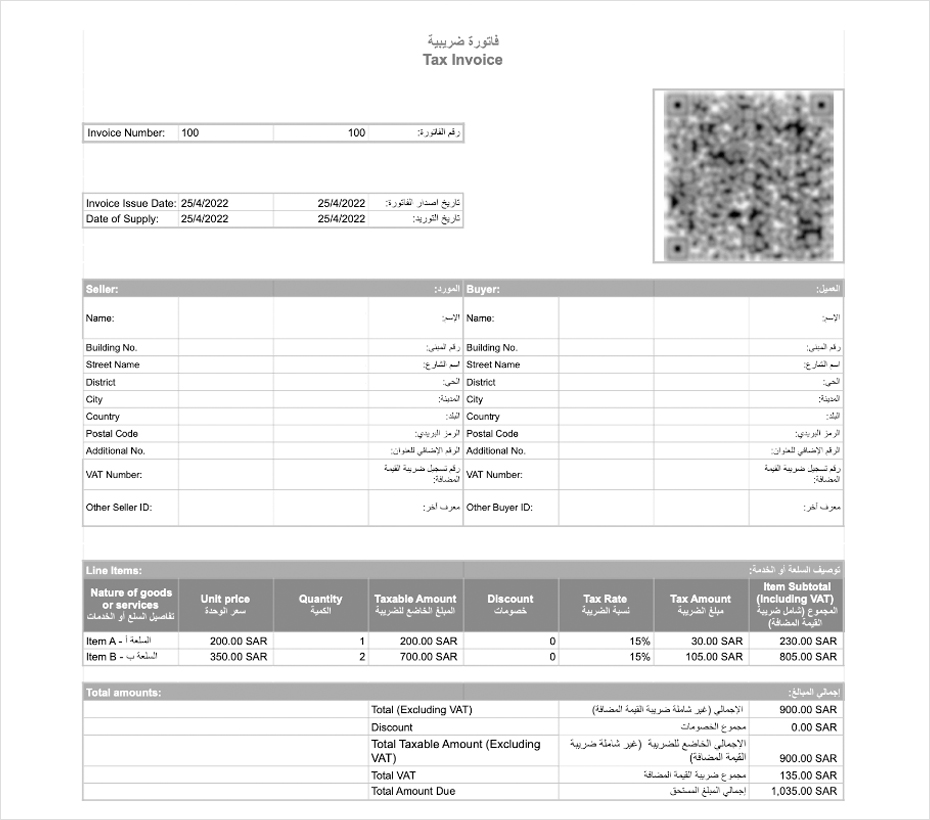

For KSA VAT taxpayers, e-invoices will resemble the VAT tax invoices that are generally issued, but will be generated

through an online system. Do note that a paper invoice that is copied or scanned is not considered an e-invoice.

Once issued, an e-invoice cannot be edited. However, you can issue electronic notes (debit and credit notes that are VAT compliant

and issued through an electronic system). These should be issued with reference to the original invoice that was issued.

For instance, if your buyer has returned your product, you cannot alter the original invoice, but you can issue a credit

note through the e-invoicing system.